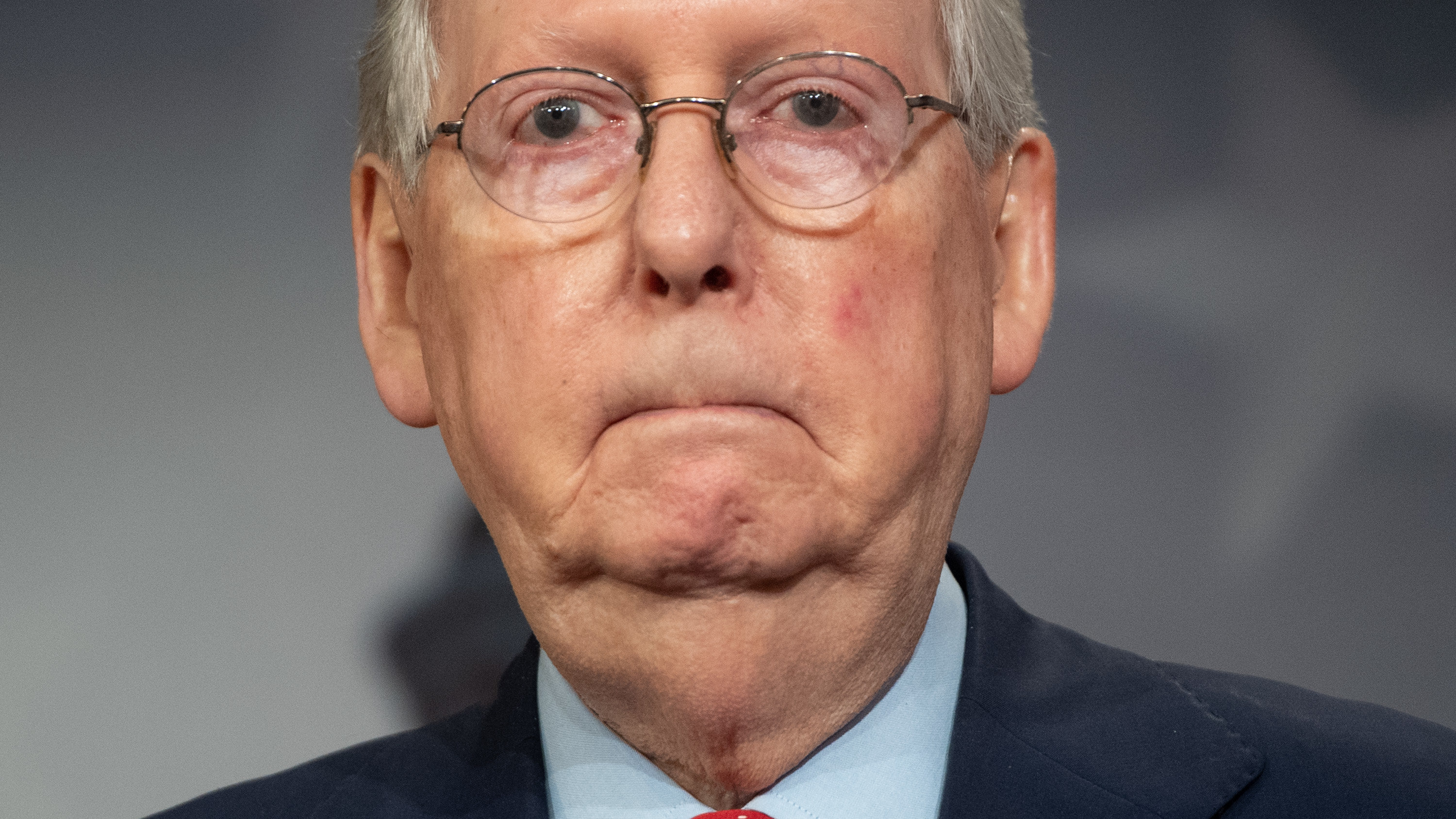

Mitch McConnell's Care Act 2: Key Details & Impact

The second Coronavirus Aid, Relief, and Economic Security (CARES) Act, a significant piece of legislation enacted in response to the COVID-19 pandemic, included provisions aimed at mitigating the economic fallout. The legislation was a response to the need for substantial financial aid for individuals and businesses facing hardship. Specific details, such as funding allocations and eligibility criteria, varied within the act's provisions. Further legislative analysis might be necessary to explore the impact of the act in full detail.

The act's importance stemmed from its comprehensive approach to supporting the nation's economic recovery. It included significant financial aid packages for individuals and businesses, unemployment benefits, and funding for healthcare infrastructure. The legislation, although controversial in certain aspects, aimed to provide much-needed relief during a critical period of economic disruption. Historical context suggests such legislation is often necessary during periods of widespread economic distress and requires careful consideration in both implementation and evaluation. Its effects on various economic sectors and demographic groups should be closely examined for a full understanding of the legislation's impact.

This article will now delve into the specifics of the act's provisions, examining its economic and social impact and considering its role in the broader national response to the pandemic.

Mitch McConnell and the CARES Act (2nd iteration)

Analyzing the second iteration of the CARES Act requires understanding its legislative context and impact. Key aspects are crucial for comprehending the act's significance.

- Economic relief

- Small business aid

- Unemployment benefits

- Funding for healthcare

- Debate and controversy

- Legislative process

- Long-term effects

The CARES Act's economic relief package, central to its second iteration, addressed the economic devastation caused by the COVID-19 pandemic. Small business aid provided vital support, while unemployment benefits helped mitigate job loss. Funding for healthcare infrastructure proved critical during the crisis. The act's passage involved considerable debate and controversy, highlighting differing perspectives on its scope and effectiveness. The legislative process, shaped by political considerations, inevitably influenced the act's specifics. Ultimately, understanding long-term effects on various sectorsfrom healthcare to employmentis vital for assessing the act's true significance. For example, analyzing the impact on specific industries or demographic groups can offer a deeper understanding of the legislation's outcomes.

1. Economic relief

The second Coronavirus Aid, Relief, and Economic Security Act (CARES Act) focused heavily on economic relief. This component aimed to mitigate the severe economic disruption caused by the COVID-19 pandemic. The legislation's provisions sought to support various sectors and individuals affected by the crisis, with a primary goal of bolstering the economy. The need for economic relief was demonstrably urgent, as millions faced job losses, business closures, and diminished income. The act's provisions included direct payments to individuals, enhanced unemployment benefits, and funding for small businesses, all designed to stimulate economic activity and prevent a deeper recession.

The economic relief provisions of the second CARES Act represented a substantial effort to counteract the negative economic consequences of the pandemic. This is exemplified by direct cash transfers, which provided immediate financial support to individuals, and the expansion of unemployment insurance benefits, bolstering those whose livelihoods were impacted. The act's impact on specific sectors, such as small businesses, also warrants attention. The legislation also included provisions designed to support healthcare systems struggling under pandemic strain. The practical significance of understanding this is to provide insights into the effectiveness of government intervention in mitigating economic crises. Such analysis helps in developing effective strategies for future economic downturns and underscores the critical role economic relief plays in economic stability.

In summary, the economic relief component of the second CARES Act was a crucial element in the government's response to the pandemic's economic fallout. The legislations immediate impact, though complex to fully measure, is undeniable, and understanding its provisions and their effects is critical for policy-making in future crises. Analysis of the economic relief's success, failures, and lingering effects is essential to informing future responses to economic hardship. This understanding has practical implications for the design and implementation of effective economic stabilization measures during times of crisis.

2. Small business aid

Small business aid provisions within the second CARES Act were a critical component of the legislation's response to the economic fallout of the COVID-19 pandemic. The act recognized the vital role small businesses play in the economy and sought to provide them with crucial support during a period of substantial disruption. Understanding these provisions illuminates the legislation's intentions and implications for the economic recovery.

- Loan programs and grants.

The act established various loan programs and grants designed to assist small businesses struggling with reduced revenue and operational challenges. These initiatives aimed to provide financial relief, enabling businesses to maintain operations, cover expenses, and retain employees. Examples included the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL) which, though not exclusively part of the CARES Act 2, were significantly impacted and influenced by it. These loans and grants offered flexibility in terms of repayment, allowing businesses to focus on recovery and avoiding immediate insolvency. A significant implication of these measures was the direct support they offered to entrepreneurs and small business owners who faced potentially insurmountable obstacles without financial assistance.

- Tax credits and deductions.

The act also included provisions offering tax credits and deductions to small businesses. These incentives were intended to reduce the financial burden on businesses, encouraging them to invest, create jobs, or continue operating. The specific nature of tax credits and deductions might have varied across different business types. These provisions aimed to enhance profitability and sustainability and support business resilience through tax relief. This facet highlights the act's multifaceted approach to aiding small businesses, aiming to improve their long-term financial health.

- Flexibility in requirements.

Crucially, the second CARES Act emphasized flexibility in requirements for accessing aid. This approach aimed to address the unique challenges faced by different types of small businesses. This aspect aimed to avoid a "one-size-fits-all" approach to assistance, understanding that various businesses have distinctive needs. The legislative intention was to provide targeted help where it was needed most and to reduce administrative obstacles to access these benefits. Practical implementation and accessibility were emphasized for maximum effectiveness.

- Focus on job preservation.

A primary concern in the small business aid provisions was the preservation of jobs. The goal was to help businesses maintain employment during economic instability, thereby avoiding further unemployment and societal hardship. The rationale was that job retention contributed to maintaining communities and avoiding a larger economic downturn. The legislative intent clearly focused on supporting businesses as economic engines in the community, safeguarding jobs while encouraging recovery. Examples might include extending eligibility criteria for certain aid programs.

The small business aid provisions of the second CARES Act aimed to offer immediate and targeted assistance. The legislation recognized the crucial role of these businesses in the economic landscape, providing necessary tools to navigate the challenges and obstacles presented by the pandemic. The multifaceted approachincluding loans, grants, tax incentives, and flexible requirementsdemonstrates a concerted effort to address the unique circumstances of numerous small businesses. However, the long-term effectiveness and broader consequences of these provisions require ongoing analysis to assess the overall impact and inform future economic policies.

3. Unemployment benefits

The second Coronavirus Aid, Relief, and Economic Security Act (CARES Act) significantly impacted unemployment benefits, extending and modifying existing programs in response to widespread job losses triggered by the COVID-19 pandemic. The legislation's provisions regarding unemployment benefits highlight the crucial role of government intervention during economic crises.

- Expanded Eligibility and Benefits.

A key aspect of the legislation was expanding eligibility criteria for unemployment benefits. This expansion often included individuals in sectors particularly hard-hit by the pandemic, such as hospitality and retail. The act also frequently increased the duration and amount of benefits available to those laid off, providing crucial financial support during a period of substantial economic instability. These changes sought to mitigate the immediate economic hardship faced by millions of Americans.

- Federal Funding and State Administration.

The CARES Act provided significant federal funding to supplement state unemployment insurance programs. This crucial financial support enabled states to maintain and expand their existing unemployment systems, minimizing the strain on state budgets and allowing them to effectively manage the increase in claims. However, the allocation of funds and the implementation of the programs remained largely under the purview of state authorities.

- Controversy and Challenges.

The legislation's provisions for unemployment benefits encountered controversy and challenges, often stemming from varying perspectives on the duration, amount, and eligibility criteria of benefits. The rapid and dramatic increase in unemployment claims caused difficulties in efficiently processing applications and distributing funds, leading to delays in receipt of benefits for some individuals and generating criticism over the effectiveness and speed of the program's execution. The impact on individual experiences varied depending on individual circumstances and state-level administration.

- Long-Term Implications.

The effects of the CARES Act's provisions on unemployment benefits extended beyond the immediate crisis period. The legislation's impact on existing unemployment insurance systems, especially regarding funding, eligibility rules and benefit levels, remained a point of debate and policy discussion in the aftermath of the pandemic. The experience gained during the crisis was crucial for reforming and improving unemployment insurance systems for future economic emergencies.

In conclusion, the unemployment benefits component of the second CARES Act represented a critical government response to the pandemic's devastating economic impact. The legislation's provisions, while encountering challenges in implementation and prompting controversy, provided crucial support for millions of unemployed individuals. However, the long-term consequences of these measures, particularly the effects on state-level unemployment systems and future policy, remain pertinent subjects of analysis.

4. Funding for healthcare

The second Coronavirus Aid, Relief, and Economic Security Act (CARES Act) allocated significant funds to bolster healthcare infrastructure and resources. These allocations were crucial in addressing the immediate and substantial strain placed on the healthcare system during the COVID-19 pandemic. The act's impact on healthcare funding warrants careful examination regarding the allocation, implementation, and overall effectiveness of these provisions.

- Direct financial aid to healthcare providers.

The act often included direct financial aid for hospitals and healthcare facilities, particularly those experiencing increased costs due to the surge in COVID-19 patients. This funding could have covered a range of expenses, from additional staff salaries to purchasing protective equipment and ventilators. This direct financial support sought to ensure the continued operational capacity of healthcare providers during the crisis, avoiding potential collapse of the system under overwhelming demand. Examples could involve specific grants and loan programs tailored to address the unique needs of these facilities.

- Expansion of testing and treatment capacity.

Funding frequently addressed the need for increased testing capabilities, facilitating rapid and widespread testing for COVID-19. This investment aimed to better understand the disease's spread and support timely patient care. Furthermore, funding allocated toward treatment options could include research and development or acquisition of existing treatments. This facet's significance lies in its contribution to effective disease management and mitigation of its spread. Examples might include funding for the creation of new testing centers or equipment and the development of treatment protocols.

- Support for telehealth services.

The CARES Act frequently included funding targeted at expanding and improving telehealth services. This provision aimed to ensure continued access to healthcare, particularly for individuals who could not easily access physical facilities. Increased funding for virtual platforms and remote consultation tools facilitated crucial continuity of care during the pandemic. Examples could include grants to healthcare providers for adopting telehealth technologies and initiatives to train healthcare professionals in telehealth practices.

- Addressing disparities in healthcare access.

Some provisions within the CARES Act may have sought to address disparities in healthcare access, specifically targeting underserved communities disproportionately affected by the pandemic. This facet likely involved funding for outreach programs and initiatives aimed at ensuring equitable access to care and resources. Examples could encompass funding for community health centers in underserved areas or programs to educate populations at higher risk about preventive measures and treatment options.

The healthcare funding provisions within the CARES Act aimed to bolster the nation's capacity to manage the pandemic. Understanding the specific allocations and their implementation is crucial for assessing the legislation's overall impact on the healthcare system. Further analysis might explore the long-term effects of these funding decisions on healthcare accessibility, equity, and the broader healthcare infrastructure. These provisions highlight the significant link between government intervention and the ability of the healthcare system to address major health crises.

5. Debate and controversy

Debate and controversy surrounding the second Coronavirus Aid, Relief, and Economic Security Act (CARES Act) were inherent aspects of the legislation. The act's substantial scope, encompassing economic relief, small business aid, unemployment benefits, and healthcare funding, naturally invited diverse viewpoints. Political considerations, differing economic philosophies, and divergent perspectives on the pandemic's impact fueled these discussions. Analyzing this debate is crucial for understanding the legislative process and the broader context surrounding the act's passage. Criticism often centered on the scale of spending, perceived inefficiencies, and potential long-term consequences.

Specific points of contention frequently included the allocation of funds, the design of aid programs, and the adequacy of measures to address various societal needs. Arguments arose regarding the targeted nature of assistance, the extent of aid directed toward specific sectors, and concerns over potential unintended consequences. For example, debate surrounding the Paycheck Protection Program (PPP) highlighted disagreements on loan forgiveness criteria and the program's effectiveness in preserving jobs. Disagreements regarding the effectiveness of various stimulus measures and the best approach to economic recovery played a significant role in the ongoing discussion surrounding the CARES Act. The influence of partisan politics on the legislative process further contributed to the debate and controversy surrounding the legislation.

Understanding the debate and controversy surrounding the second CARES Act is essential for several reasons. It illuminates the complexities of policy-making during a crisis and underscores the diverse perspectives on effective solutions. Examining the arguments presented and the different legislative approaches considered reveals potential trade-offs between short-term relief and long-term economic stability. It further demonstrates the political and economic factors that shape policy development. This understanding also aids in evaluating the effectiveness of the act's provisions, highlighting both successes and areas for improvement in future crisis responses. Furthermore, the analysis of political discourse surrounding the act provides context for evaluating similar legislative initiatives in the face of future economic or social challenges.

6. Legislative process

The legislative process played a critical role in the passage of the second Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The act's creation and implementation were deeply intertwined with the structure, procedures, and political dynamics of the legislative branch. The legislative process, with its inherent steps and considerations, significantly shaped the final form of the act. The influence of political parties, including the role of key figures like Mitch McConnell, was a significant factor. Understanding the specifics of this process is crucial to evaluating the act's effectiveness and its impact.

The legislative process, including the various committees, hearings, and debates, dictated how the act evolved. The process often determines the scope and specificity of legislation, including provisions for economic relief, small business aid, unemployment benefits, and healthcare funding. Real-world examples demonstrate how differing committee priorities and the influence of particular senators affected the final legislation. For instance, compromises and amendments arising from committee discussions often altered the initial proposals. The act's passage often involved navigating partisan disagreements, affecting the scope and provisions. Such dynamics are frequently observed across significant legislation in American history, emphasizing the importance of understanding the specific legislative context surrounding the act.

The legislative process, within its various stages and complexities, impacted the final product of the CARES Act, highlighting the interplay between political will, economic realities, and societal needs. Understanding these influences helps assess the act's potential shortcomings and long-term effects. This crucial insight informs future policy formulation and highlights the value of meticulous attention to legislative procedure in ensuring effective responses to national emergencies. Furthermore, recognizing the importance of the legislative process for understanding and assessing the outcomes of significant legislation enhances the ability to anticipate and address potential challenges and their long-term impacts.

7. Long-term effects

Assessing the long-term effects of the second Coronavirus Aid, Relief, and Economic Security Act (CARES Act) necessitates a comprehensive understanding of its provisions and their subsequent impact on various sectors. The legislation's multifaceted nature, encompassing economic relief, small business aid, unemployment benefits, and healthcare funding, introduces complex cause-and-effect relationships that extend beyond the immediate crisis period. The act's provisions aimed at mitigating short-term economic distress, but the long-term consequences for individuals, businesses, and the overall economy remain subjects of ongoing analysis. A clear understanding of these effects is essential to informed policy-making and economic forecasting, particularly in addressing future crises.

Analyzing the long-term effects requires exploring potential consequences in areas like employment trends, economic inequality, and the evolution of healthcare systems. For example, the impact of extended unemployment benefits on individual work habits and labor market participation warrants examination. The effectiveness of small business aid in fostering long-term viability and job creation requires careful tracking and analysis. Long-term impacts extend to public debt, future tax burdens, and the potential for inflationary pressures. Evaluating the long-term effects of the act's provisions on healthcare infrastructure, including the sustainability of expanded telehealth services and the impact on hospital capacity, necessitates a broader perspective. Furthermore, the evolving economic landscape and its influence on the success or failure of specific legislative measures need to be considered. Historical precedents in economic crises offer further insight, though each situation presents unique dynamics and contingencies.

Ultimately, understanding the long-term effects of the CARES Act provides a crucial perspective for future policy formulation. The analysis necessitates careful consideration of the legislation's intended outcomes, its implementation, and the evolving economic environment. Challenges in accurately predicting long-term effects arise from inherent complexities in economic systems, unexpected market fluctuations, and the multifaceted nature of societal responses. This rigorous exploration of cause and effect is vital to refining policy responses to future economic crises, minimizing unintended consequences, and ensuring more effective economic relief measures. By thoroughly analyzing the long-term effects of the CARES Act, policymakers and economists can better prepare for future economic downturns and refine future legislative interventions.

Frequently Asked Questions

This section addresses common questions and concerns regarding the second Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The following questions and answers provide context and clarity on key aspects of this legislation.

Question 1: What was the primary objective of the second CARES Act?

The primary objective was to provide economic relief and support during the COVID-19 pandemic. This included measures to mitigate job losses, bolster small businesses, enhance healthcare capacity, and aid individuals experiencing financial hardship.

Question 2: How did the second CARES Act affect unemployment benefits?

The act expanded eligibility criteria and increased the duration and amount of unemployment benefits available to individuals affected by job losses. Federal funding supplemented state unemployment insurance programs, but implementation varied across states.

Question 3: What were the key provisions for small business aid within the second CARES Act?

The act included loan programs, grants, and tax incentives to support small businesses. These initiatives aimed to help businesses maintain operations, retain employees, and navigate the economic challenges presented by the pandemic. Specific programs like the Paycheck Protection Program (PPP) were part of this effort.

Question 4: What role did healthcare funding play in the second CARES Act?

The act allocated significant funds to strengthen healthcare infrastructure and resources. This included support for hospitals, increased testing capacity, and expansion of telehealth services. These provisions addressed the critical demands on healthcare systems during the pandemic.

Question 5: What were some criticisms or controversies surrounding the second CARES Act?

Criticism frequently focused on the scale of spending, perceived inefficiencies in aid programs, and potential long-term economic consequences. Concerns also arose regarding the allocation of resources and the effectiveness of certain provisions.

Question 6: What was the legislative process like for the second CARES Act?

The passage of the act involved negotiation, debate, and compromise within the legislative branch. Political considerations, varying perspectives, and committee actions all influenced the final form of the legislation. The process demonstrates the complexity of policy-making during times of crisis.

These FAQs provide a concise overview of key aspects of the second CARES Act. Further research is recommended for a deeper understanding of the legislation's specific provisions and long-term impact.

The following sections will delve deeper into the specifics of individual provisions, examining their economic and social impacts.

Tips for Understanding the Second CARES Act

The second Coronavirus Aid, Relief, and Economic Security Act (CARES Act) offered substantial economic relief during the COVID-19 pandemic. Navigating its complexities requires a structured approach. These tips offer a practical framework for understanding the legislation's provisions and their implications.

Tip 1: Focus on the Act's Specific Objectives. The CARES Act addressed immediate economic challenges. Understanding its goalsalleviating unemployment, supporting small businesses, and bolstering healthcare infrastructureis crucial for contextualizing its provisions. Distinguishing between temporary relief and long-term economic strategies helps avoid misinterpretations.

Tip 2: Analyze Funding Allocations. Scrutinize how funding was distributed among different sectors. Understanding which programs received the largest allocations reveals priorities and potential impacts on economic recovery. Comparative analysis of funding models can illustrate potential inefficiencies or effectiveness.

Tip 3: Evaluate the Effectiveness of Aid Programs. Consider the intended outcomes of specific programs, such as small business loans or unemployment benefits. Evaluating program participation rates, loan defaults, and long-term job creation data provides insights into the program's effectiveness. Quantifiable metrics are essential for this evaluation.

Tip 4: Consider the Legislative Context. The CARES Act's enactment occurred within a specific political and economic climate. Understanding the prevailing circumstances and the factors influencing the legislative process clarifies potential biases or priorities embedded in the legislation. Contextualizing historical precedent for similar economic crises provides relevant insight.

Tip 5: Recognize Potential Unintended Consequences. Evaluating the legislation requires considering potential long-term effects beyond the immediate crisis. Analyzing potential inflationary pressures, impacts on labor markets, or changes in consumer behavior provides a broader perspective. This foresight allows for mitigation strategies to address potential long-term concerns.

Tip 6: Identify the Role of Stakeholders. Consider the perspectives of various stakeholders involved, such as businesses, individuals, and government agencies. Examining their perspectives and incentives reveals the multifaceted impacts of the act. Understanding these nuanced perspectives fosters a more comprehensive analysis.

By following these tips, a clearer comprehension of the CARES Act's objectives, provisions, and long-term effects can be achieved. This approach facilitates a more informed perspective on this complex legislation and its place within the broader economic context.

The following sections will delve deeper into specific aspects of the legislation, providing additional context and analysis. Understanding the second CARES Act requires careful consideration of its multifaceted nature and long-term ramifications.

Conclusion

The second Coronavirus Aid, Relief, and Economic Security Act (CARES Act) represented a significant government intervention in response to the economic fallout of the COVID-19 pandemic. This analysis explored the act's key provisions, encompassing economic relief, small business assistance, unemployment benefits, and healthcare funding. The legislation's multifaceted approach aimed to address immediate crises while considering long-term implications. Examining the legislative process, highlighting debates and controversies, and assessing the long-term effects of the act reveals the complex interplay of political considerations, economic realities, and societal needs. The act's impact on unemployment rates, small business survival, and healthcare infrastructure are crucial areas of further investigation. Further study is needed to fully understand how these aspects shaped the economic recovery trajectory and long-term outcomes.

The second CARES Act's legacy is complex and multifaceted, demonstrating both the potential and limitations of government intervention during economic crises. The act's success in mitigating the immediate fallout is undeniable, yet its long-term consequences require ongoing evaluation. Policymakers and economists must consider the intricate relationship between short-term relief and long-term economic stability. Understanding these dynamics is essential for developing more effective crisis response strategies in the future. Further research and analysis of similar legislative initiatives in future economic downturns can yield valuable insights for crafting robust and targeted policy interventions.

Article Recommendations